top of page

NEWS & UPDATES

Search

Union Budget 2026: Major Direct Tax Changes That Will Impact Every Taxpayer and Business

Union Budget 2026 introduces sweeping direct tax reforms under the Income-tax Act, 2025, aimed at simplifying compliance, reducing litigation, and improving cash flow for taxpayers and businesses. From digital TDS processes and updated return flexibility to relief for property buyers, employers, investors, and cooperatives, these changes mark a decisive shift toward a more transparent, predictable, and trust-based tax system in India.

PRAVEEN DILLIBABU

5 days ago4 min read

📘 5 GST & Income Tax Filing Mistakes That Trigger Notices

Learn the top 5 GST and Income Tax filing mistakes that trigger notices today. Updated RDTA guide with simple explanations and fixes.

PRAVEEN DILLIBABU

Dec 10, 20253 min read

GST GSTR-9 & GSTR-9C Annual Return — Complete Simplified Guide for FY 2024–25

“A complete, easy-to-understand guide to GSTR-9 and GSTR-9C annual returns. Learn who must file, turnover limits, common mistakes, penalties, and a step-by-step checklist to ensure accurate GST compliance.”

PRAVEEN DILLIBABU

Dec 7, 20254 min read

Income Tax — Understanding Advance Tax & Self-Assessment Tax (Complete Guide)

A clear and practical guide explaining Advance Tax and Self-Assessment Tax, who needs to pay, due dates, calculation method, penalties, and expert tips to avoid interest. Perfect for individuals and business owners.

PRAVEEN DILLIBABU

Dec 3, 20253 min read

🚀 Startup India Tax Exemptions — Complete Guide 2025

A complete, founder-friendly guide on Startup India tax exemptions including 80-IAC tax holiday, angel tax exemption, capital gains benefits, eligibility, documents, and step-by-step application process — explained clearly by RDTA.

PRAVEEN DILLIBABU

Nov 29, 20254 min read

GST E-Invoicing Rules & Latest Applicability Thresholds (Official Guide)

A friendly and simple guide explaining the official GST e-invoicing applicability thresholds, exemptions, step-by-step process, penalties, and compliance tips — updated with the latest ₹5 crore rule.

PRAVEEN DILLIBABU

Nov 27, 20253 min read

How to Read a Balance Sheet Like a Pro

A simple, clear guide that teaches business owners how to read a balance sheet like a pro. Learn assets, liabilities, ratios, warning signs, and practical examples.

PRAVEEN DILLIBABU

Nov 24, 20254 min read

GST – LUT Filing for Exporters: Step-by-Step Guide

A clear and complete guide to GST LUT Filing for exporters. Learn eligibility, documents, benefits, step-by-step filing, validity, renewal rules, and common mistakes.

PRAVEEN DILLIBABU

Nov 20, 20253 min read

Udyam Registration & MSME Benefits Explained — A Complete Guide for Indian Businesses

Complete guide to Udyam Registration for MSMEs. Learn classification, documents, eligibility, benefits, and step-by-step registration for Micro, Small & Medium businesses.

PRAVEEN DILLIBABU

Nov 18, 20254 min read

Private Limited vs LLP vs Partnership Firm vs Proprietorship — Which Business Structure Should You Choose?

A professional 2025 guide comparing Private Limited, LLP, Partnership Firm, and Proprietorship structures in India. Includes compliance updates, legal differences, tax benefits, cost comparison, and RDTA’s expert framework for choosing the right business structure. Ideal for startups, small businesses, and growing enterprises.

PRAVEEN DILLIBABU

Nov 14, 20254 min read

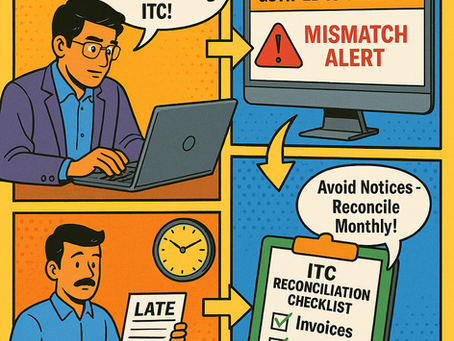

GST Input Tax Credit (ITC) Reconciliation – Avoiding Mismatches & Notices (2025 Edition)

Learn how to avoid GST ITC mismatches with proper GSTR-2B and 3B reconciliation. Expert guide by Revenue Dynamics Tax Advisory for 2025 compliance.

PRAVEEN DILLIBABU

Nov 13, 20255 min read

TDS & TCS Compliance: Avoiding the Common Pitfalls

Avoid penalties and mismatches in TDS and TCS filing. Learn the most common compliance mistakes and professional tips from Revenue Dynamics Tax Advisory.

PRAVEEN DILLIBABU

Nov 12, 20254 min read

Documents Required for GST Registration – A Complete Checklist for Businesses

Updated list of documents required for GST registration in India 2025. Learn eligibility, document checklist, and expert filing guidance from Revenue Dynamics Tax Advisory.

PRAVEEN DILLIBABU

Nov 11, 20253 min read

How to Respond to Income Tax Notices Professionally – Step-by-Step Guide

Learn how to respond to Income Tax Notices under Sections 143(1), 142(1), 139(9), and 148A. Step-by-step response process and professional tips from Revenue Dynamics Tax Advisory.

PRAVEEN DILLIBABU

Nov 9, 20252 min read

How to Register Your Startup under DPIIT and Access Startup India Benefits

Learn how to register your startup under DPIIT and access Startup India benefits. Step-by-step guide with eligibility, process, and tax exemptions explained by Revenue Dynamics Tax Advisory.

PRAVEEN DILLIBABU

Nov 8, 20253 min read

GST Refund Process for Exporters Explained — Upcoming 90% Instant Refund Reform

Understand the GST refund process for exporters in India. Learn about RFD-01 filing, zero-rated supplies, and the upcoming 90% automatic refund system that accelerates cash flow for exporters.

PRAVEEN DILLIBABU

Nov 7, 20253 min read

Presumptive Taxation under Sections 44AD, 44ADA & 44AE – Simplified for Small Businesses and Professionals

Learn the Presumptive Taxation Scheme under Sections 44AD, 44ADA & 44AE – eligibility, turnover limits, rates, and benefits for small businesses, professionals and transporters. Stay compliant with Revenue Dynamics Tax Advisory.

PRAVEEN DILLIBABU

Nov 6, 20253 min read

New GST Return Filing System – Key Changes from 2025

The Goods and Services Tax Network (GSTN) is moving toward a smarter and more transparent filing process through the proposed GST Smart Return (FORM RET-1) — a unified return form designed to simplify compliance and reduce filing errors.

PRAVEEN DILLIBABU

Nov 5, 20253 min read

Simplified GST Registration Introduced Under Rule 14A – Effective from 1st November 2025 – GST Approval in 3 Days

GST Registration under Rule 14A — Faster Registration, Simplified Exit & Reduced Compliance Load. Get GST approval within just 3 days with the new simplified registration scheme for taxpayers.

PRAVEEN DILLIBABU

Nov 1, 20252 min read

Streamline Your Operations with Custom SOPs

In today's fast-paced business world, efficiency is key. Companies are always looking for ways to improve their operations. One effective method is through the use of Standard Operating Procedures (SOPs). Custom SOPs can help streamline your operations, reduce errors, and enhance productivity. In this post, we will explore what SOPs are, why they are important, and how to create custom SOPs that fit your business needs. What Are Standard Operating Procedures (SOPs)? Standard

PRAVEEN DILLIBABU

Oct 14, 20254 min read

bottom of page