GST GSTR-9 & GSTR-9C Annual Return — Complete Simplified Guide for FY 2024–25

- PRAVEEN DILLIBABU

- Dec 7, 2025

- 4 min read

By Revenue Dynamics Tax Advisory

Published: 28 November 2025

Category: GST/Compliance

1. Executive Summary - GSTR 9 and GSTR 9C Annual Return

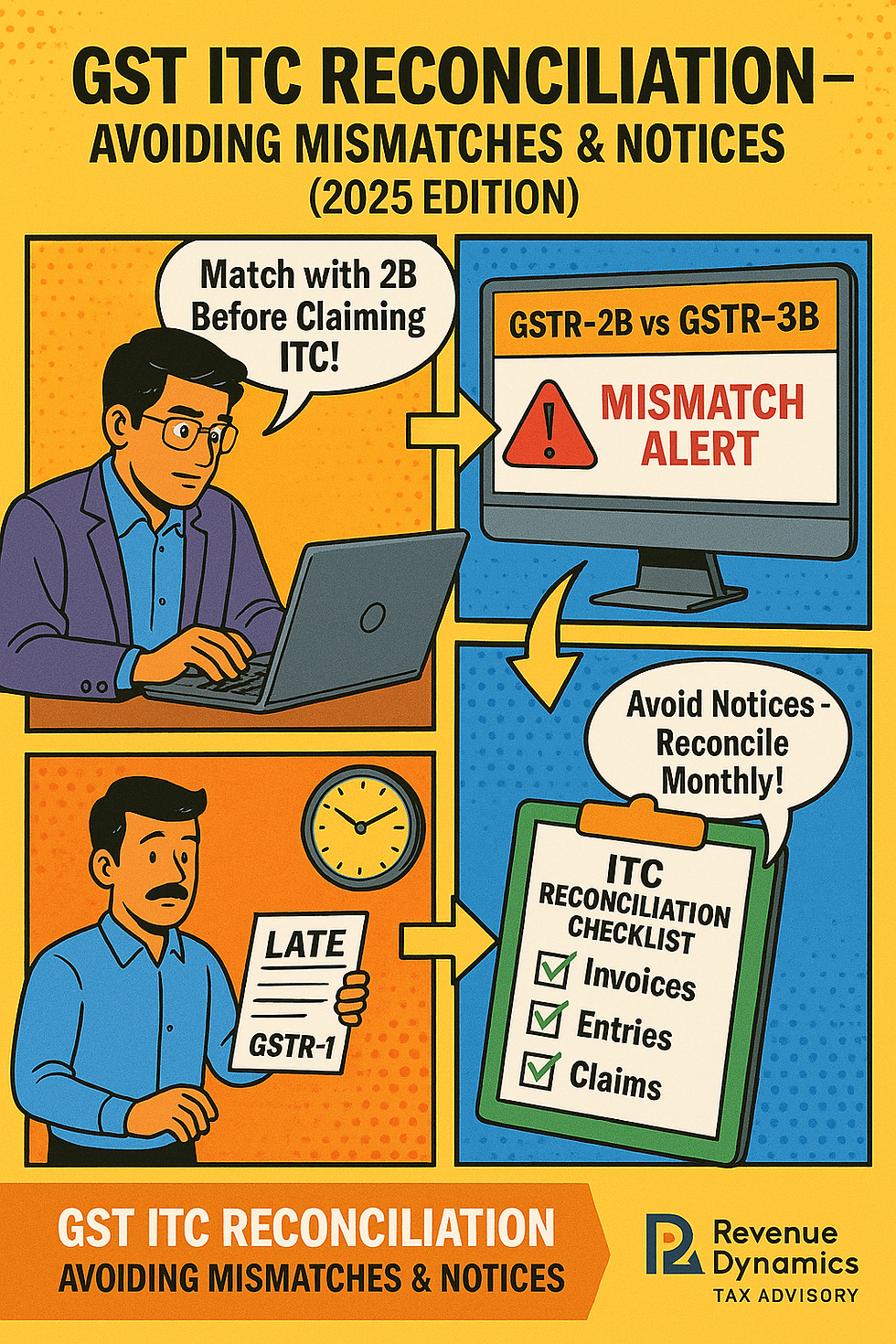

Every registered business under GST must complete its annual compliance through GSTR-9 (Annual Return) and, for eligible businesses, GSTR-9C (Reconciliation Statement certified by a CA/CMA). These forms ensure your monthly/quarterly GST filings match your books of accounts and help avoid future notices, mismatches, and penalties.

For FY 2024–25, businesses must follow turnover-based rules to determine whether GSTR-9 or GSTR-9C applies.

This guide simplifies both forms: eligibility, deadlines, requirements, common mistakes, and an RDTA-style compliance checklist to help businesses complete annual filings accurately.

2. What Is GSTR-9?

GSTR-9 is the consolidated annual return summarising:

Outward supplies

Inward supplies

Input Tax Credit (ITC)

Amendments

HSN summaries

Tax paid & liability adjustments

It ensures your GSTR-1, GSTR-3B, books of accounts, and GSTR-2B all align.

Who Must File GSTR-9?

Based on CBIC notification patterns over the past FYs:

Turnover > ₹2 crore → GSTR-9 filing is MANDATORY

Turnover ≤ ₹2 crore → GSTR-9 is OPTIONAL(Subject to official exemption notification for the current FY.)

This ₹2 crore exemption has been repeated across CBIC Notifications 47/2019, 79/2020, 31/2021, 14/2022 and is expected to continue unless updated.

Who is exempt (usually)?

Composition taxpayers

Non-resident taxable persons

ISDs

Casual taxable persons

TDS/TCS deductors

3. What Is GSTR-9C?

GSTR-9C is a reconciliation statement filed by businesses above a certain turnover limit.

It compares:

Books of accounts

Taxable turnover as per GST returns

ITC claimed vs actual

Tax paid vs tax payable

The form must be certified by a CA or CMA.

Who Must File GSTR-9C?

Turnover > ₹5 crore → GSTR-9C filing is MANDATORY

Turnover ≤ ₹5 crore → GSTR-9C NOT required

4. GSTR-9 vs GSTR-9C — What’s the Difference?

Feature | GSTR-9 | GSTR-9C |

Purpose | Annual summary of all GST transactions | Reconciliation between books & GSTR-9 |

Turnover Rule | Mandatory above ₹2 crore | Mandatory above ₹5 crore |

Who Files? | All regular taxpayers (except exempt categories) | Only businesses exceeding the turnover threshold |

Certification | No CA required | CA/CMA certification required |

Filing Deadline | Annual | Annual (along with GSTR-9) |

Complexity | Moderate | High–detailed audit-style review |

5. Step-by-Step Understanding of GSTR-9

GSTR-9 consists of multiple parts:

A. Basic Details

Pre-filled from registration data.

B. Outward Supplies

Includes:

Taxable outward supplies

Exempt/nil-rated supplies

Adjustments

Credit/debit notes

C. Input Tax Credit (ITC)

You must report:

ITC availed

ITC reversed

Ineligible ITC (Sec 17)

D. Tax Paid Summary

Consolidation of tax paid through GSTR-3B.

E. Amendments

Adjustments made after the year-end but allowed within the time limit.

F. HSN Summary

HSN-wise inward and outward supplies.

6. Step-by-Step Understanding of GSTR-9C

This statement reconciles:

Turnover (Books vs GST)

ITC (Books vs GSTR-3B vs 2B)

Tax payments

Differences and explanations

It must be verified and certified by a Chartered Accountant or Cost Accountant.

7. RDTA Simplified Checklist for GSTR-9 & 9C Filing

🔹 A. Pre-Filing Checks

Ensure all GSTR-1 & GSTR-3B are filed for the FY

Reconcile GSTR-2B vs the purchase register

Check if any supplier has not uploaded invoices

🔹 B. Books vs GST Reconciliation

Compare financial statements with GST returns

Prepare adjustments for:

Unreported credit notes

Amendments

Exports

RCM liabilities

🔹 C. GSTR-9C (If Turnover > ₹5 Cr)

Provide audited financials to your CA

Prepare a reconciliation statement

Get certification before filing

🔹 D. Final Validation

Verify HSN summary

Ensure no ineligible ITC is reported as eligible

Match tax liability with payments made

8. Common Mistakes Businesses Make

❌ Mistake 1: Claiming ITC not appearing in GSTR-2B

Fix: Only claim ITC that appears in 2B unless legally allowed with adjustments.

❌ Mistake 2: Incorrect turnover reporting

Missing export invoices, RCM values, or exempt supplies.

Fix: Match turnover in books with turnover in GSTR-1 and GSTR-3B.

❌ Mistake 3: Filing GSTR-9 without checking amendments

Businesses often forget late credit notes, amendments, or corrections.

Fix: Review all GSTR-1 amendments filed after year-end.

❌ Mistake 4: Last-minute filing

Leads to errors, mismatches & late fees.

Fix: Complete reconciliation early.

9. Deadlines, Late Fees & Penalties

⏳ Due Date: Usually December 31 for the following FY

(Subject to CBIC notifications)

Late Fee for GSTR-9

₹200 per day (₹100 CGST + ₹100 SGST)

Subject to the maximum cap as notified

GSTR-9C

No specific late fee, but non-filing can trigger notices and audit scrutiny.

10. Mini Case Study (RDTA Style)

A retail business crossed ₹6.2 crore in turnover. Their books showed ITC of ₹18.4 lakh, but GSTR-2B showed only ₹17.1 lakh.

RDTA reconciled their books, identified supplier non-uploaded invoices, assisted in follow-ups, and adjusted the remaining mismatch correctly.

Outcome:✔ Correct ITC reported✔ Clean GSTR-9 & 9C filing✔ Zero notices received

11. FAQs

1. Is GSTR-9 mandatory? Mandatory if turnover exceeds ₹2 crore.

2. Is GSTR-9C mandatory? Mandatory if turnover exceeds ₹5 crore.

3. Can I revise GSTR-9? No, revision is not allowed.

4. Can a CA file GSTR-9? Yes, but certification is needed only for 9C.

5. What documents are required? Invoices, books of accounts, GSTR-1, 3B, 2B, HSN summary, and audited statements.

12. Conclusion

GSTR-9 and GSTR-9C are two of the most critical annual compliances under GST. Filing them correctly protects your business from future notices, mismatches, ITC reversals, and audit risks. With the right reconciliation process and expert guidance, businesses can file these returns smoothly and confidently.

If you need help preparing or reconciling your GSTR-9 or GSTR-9C, RDTA can assist end-to-end.

13. Contact RDTA

📞 9710675224🌐 www.rdtaxadvisory.in📧 info@rdtaxadvisory.in

Comments