top of page

NEWS & UPDATES

Search

GST GSTR-9 & GSTR-9C Annual Return — Complete Simplified Guide for FY 2024–25

“A complete, easy-to-understand guide to GSTR-9 and GSTR-9C annual returns. Learn who must file, turnover limits, common mistakes, penalties, and a step-by-step checklist to ensure accurate GST compliance.”

PRAVEEN DILLIBABU

Dec 7, 20254 min read

GST E-Invoicing Rules & Latest Applicability Thresholds (Official Guide)

A friendly and simple guide explaining the official GST e-invoicing applicability thresholds, exemptions, step-by-step process, penalties, and compliance tips — updated with the latest ₹5 crore rule.

PRAVEEN DILLIBABU

Nov 27, 20253 min read

GST – LUT Filing for Exporters: Step-by-Step Guide

A clear and complete guide to GST LUT Filing for exporters. Learn eligibility, documents, benefits, step-by-step filing, validity, renewal rules, and common mistakes.

PRAVEEN DILLIBABU

Nov 20, 20253 min read

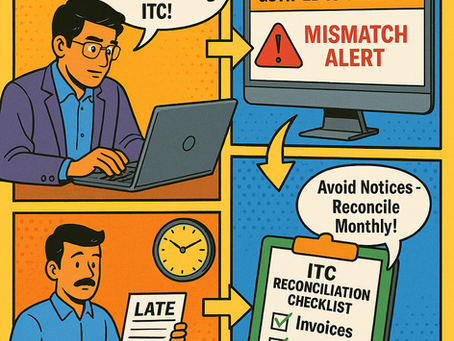

GST Input Tax Credit (ITC) Reconciliation – Avoiding Mismatches & Notices (2025 Edition)

Learn how to avoid GST ITC mismatches with proper GSTR-2B and 3B reconciliation. Expert guide by Revenue Dynamics Tax Advisory for 2025 compliance.

PRAVEEN DILLIBABU

Nov 13, 20255 min read

Documents Required for GST Registration – A Complete Checklist for Businesses

Updated list of documents required for GST registration in India 2025. Learn eligibility, document checklist, and expert filing guidance from Revenue Dynamics Tax Advisory.

PRAVEEN DILLIBABU

Nov 11, 20253 min read

bottom of page